Do You Have To Pay Taxes On Inheritance In Pa . However, the amount is added to the income when qualifying for tax forgiveness. The rates for pennsylvania inheritance tax are as follows: There is no estate tax in pennsylvania nor is there a state gift tax. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. The surviving spouse does not pay a pennsylvania inheritance tax. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. Pennsylvania does not have an estate tax.

from www.formsbank.com

The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. There is no estate tax in pennsylvania nor is there a state gift tax. In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The rates for pennsylvania inheritance tax are as follows: However, the amount is added to the income when qualifying for tax forgiveness. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. Pennsylvania does not have an estate tax. The surviving spouse does not pay a pennsylvania inheritance tax.

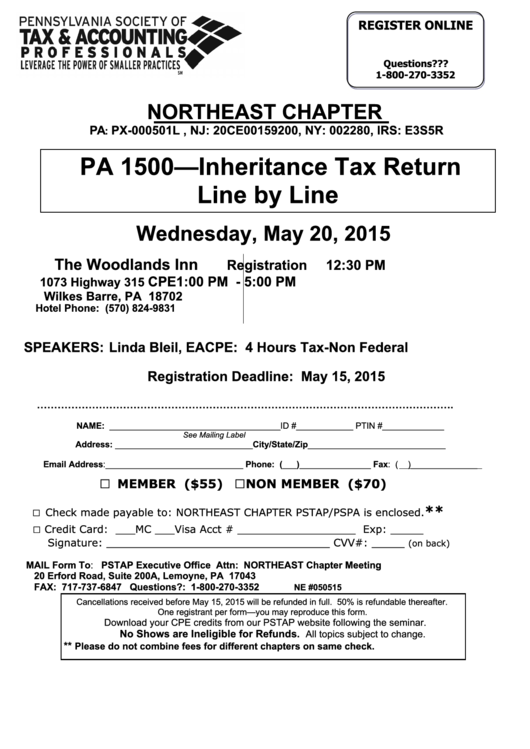

Pa 1500 Inheritance Tax Return Line By Line printable pdf download

Do You Have To Pay Taxes On Inheritance In Pa Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. The surviving spouse does not pay a pennsylvania inheritance tax. Pennsylvania does not have an estate tax. There is no estate tax in pennsylvania nor is there a state gift tax. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. However, the amount is added to the income when qualifying for tax forgiveness. The rates for pennsylvania inheritance tax are as follows: Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary.

From www.formsbank.com

Pa 1500 Inheritance Tax Return Line By Line printable pdf download Do You Have To Pay Taxes On Inheritance In Pa Pennsylvania does not have an estate tax. The rates for pennsylvania inheritance tax are as follows: There is no estate tax in pennsylvania nor is there a state gift tax. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The rates for the inheritance tax range. Do You Have To Pay Taxes On Inheritance In Pa.

From www.pghmultifamily.com

Taxes Owed on Inherited Property in Pennsylvania McIntosh Management, LP Do You Have To Pay Taxes On Inheritance In Pa No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The surviving spouse does not pay a pennsylvania inheritance tax. The rates for pennsylvania inheritance tax are as follows: Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. In pennsylvania,. Do You Have To Pay Taxes On Inheritance In Pa.

From www.taxaudit.com

I just inherited money, do I have to pay taxes on it? Do You Have To Pay Taxes On Inheritance In Pa There is no estate tax in pennsylvania nor is there a state gift tax. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The surviving spouse does not pay a pennsylvania inheritance tax. However, the amount is added to the income when qualifying for tax forgiveness.. Do You Have To Pay Taxes On Inheritance In Pa.

From wollens.co.uk

Inheritance tax threshold frozen until 2026 but why is IHT planning Do You Have To Pay Taxes On Inheritance In Pa 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. Pennsylvania does not have an estate tax. The surviving spouse does not pay a pennsylvania inheritance tax. The rates for the inheritance tax range from 4.5%. Do You Have To Pay Taxes On Inheritance In Pa.

From www.owensestateplanning.co.uk

Do I have to pay Inheritance tax (IHT)? Do You Have To Pay Taxes On Inheritance In Pa In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or.. Do You Have To Pay Taxes On Inheritance In Pa.

From cccpa.com

All You Need to Now About Inheritance Taxes at Federal and State Level Do You Have To Pay Taxes On Inheritance In Pa In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. However, the amount is added to the income when qualifying for tax forgiveness. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. The rates for pennsylvania inheritance. Do You Have To Pay Taxes On Inheritance In Pa.

From www.pennlive.com

Increase the threshold for qualifying for tax PennLive Do You Have To Pay Taxes On Inheritance In Pa There is no estate tax in pennsylvania nor is there a state gift tax. In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. However, the amount is. Do You Have To Pay Taxes On Inheritance In Pa.

From thorntonlegal.com

Will You Have to Pay Taxes on Inheritance? Thornton Law Firm Do You Have To Pay Taxes On Inheritance In Pa The surviving spouse does not pay a pennsylvania inheritance tax. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. Pennsylvania does not have an estate tax. The rates for pennsylvania inheritance tax are as follows: However, the amount is added to the income when qualifying for tax forgiveness. There is no. Do You Have To Pay Taxes On Inheritance In Pa.

From www.morganlegalny.com

ESTATE PLANNING lawyer NYC helps to pay taxes Inheritance Do You Have To Pay Taxes On Inheritance In Pa 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. The rates for pennsylvania inheritance tax are as follows: There is no estate tax in pennsylvania nor is there a state gift tax. However, the amount is added to the income when qualifying for tax forgiveness. In pennsylvania, if you were named. Do You Have To Pay Taxes On Inheritance In Pa.

From stockswalls.blogspot.com

Do You Have To Pay Taxes On Inherited Stocks Stocks Walls Do You Have To Pay Taxes On Inheritance In Pa The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. However, the amount is added to the income when qualifying for tax forgiveness. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. The rates for pennsylvania inheritance tax are as follows: No matter the size of the. Do You Have To Pay Taxes On Inheritance In Pa.

From www.ramseysolutions.com

How Does Inheritance Tax Work? Ramsey Do You Have To Pay Taxes On Inheritance In Pa 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. The rates for pennsylvania inheritance tax are as follows: Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. The surviving spouse does not pay a pennsylvania inheritance tax. However, the amount is added to the. Do You Have To Pay Taxes On Inheritance In Pa.

From herrpottsandpotts.com

PA Inheritance Tax vs PA Tax Herr Potts and Potts Do You Have To Pay Taxes On Inheritance In Pa However, the amount is added to the income when qualifying for tax forgiveness. The surviving spouse does not pay a pennsylvania inheritance tax. The rates for pennsylvania inheritance tax are as follows: Pennsylvania does not have an estate tax. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. The rates for. Do You Have To Pay Taxes On Inheritance In Pa.

From www.sellmysanantoniohouse.com

How Is Capital Gains Tax Paid On Inherited Property? Do You Have To Pay Taxes On Inheritance In Pa 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The surviving spouse does not pay a pennsylvania inheritance tax. There is no estate tax in pennsylvania nor is. Do You Have To Pay Taxes On Inheritance In Pa.

From herrpottsandpotts.com

Do Heirs Pay Inheritance Tax on IRAs in Pennsylvania? Do You Have To Pay Taxes On Inheritance In Pa Pennsylvania does not have an estate tax. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. The rates for pennsylvania inheritance tax are as follows: There is no estate tax. Do You Have To Pay Taxes On Inheritance In Pa.

From www.investorwize.com

Do you have to pay taxes on an inheritance? Do You Have To Pay Taxes On Inheritance In Pa In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. 0 percent on transfers to a surviving spouse or to a. Do You Have To Pay Taxes On Inheritance In Pa.

From inews.co.uk

Inheritance tax explained do you need to pay death duties? Do You Have To Pay Taxes On Inheritance In Pa In pennsylvania, if you were named as a beneficiary in a person’s will or by intestacy, you may have to pay taxes on property that you. The surviving spouse does not pay a pennsylvania inheritance tax. Unlike most other states, the pennsylvania inheritance tax rates are not the same for every beneficiary. 0 percent on transfers to a surviving spouse. Do You Have To Pay Taxes On Inheritance In Pa.

From sjfpc.com

Philadelphia Estate Planning, Tax, Probate Attorney Law Practice Do You Have To Pay Taxes On Inheritance In Pa The surviving spouse does not pay a pennsylvania inheritance tax. The rates for the inheritance tax range from 4.5% to 15%, depending on the exact situation. Pennsylvania does not have an estate tax. No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. However, the amount is. Do You Have To Pay Taxes On Inheritance In Pa.

From www.youtube.com

Paying Tax On Inheritance YouTube Do You Have To Pay Taxes On Inheritance In Pa Pennsylvania does not have an estate tax. The rates for pennsylvania inheritance tax are as follows: No matter the size of the estate, it will owe nothing to the state of pennsylvania before the money is dispersed to heirs. There is no estate tax in pennsylvania nor is there a state gift tax. The surviving spouse does not pay a. Do You Have To Pay Taxes On Inheritance In Pa.